Van y tir excel

Npv and irr interpretation

Calculation of NPV and IRR with the Excel function. The Microsoft Excel tool provides us with the function NPV() and IRR() where we can automatically calculate both the NPV of an investment and its IRR.

In this article I explain how to calculate these values automatically using Excel tool. I also provide you with a downloadable template with modifiable income and revenue data where you can calculate NPV or IRR of your projects and/or investments.

The NPV function calculates the net present value of an investment from a discount rate and a series of future payments (negative values) and revenues (positive values). And its syntax will be as follows:

In the previous article «IRR Rate of Return IRR and NPV Net Present Value» 3 cases are exposed , the 3 examples that apply to the template to download. As we can see both in the manual and automatic calculation by the NPV or IRR function, we obtain the same results.

Nick van exelamerican basketball coach

Net Present Value (NPV) The NPV is a financial indicator that measures the flows of future income and expenses that a project will have, to determine if, after discounting the initial investment, there will be any profit left. If the result is positive, the project is viable.

It is enough to find NPV of an investment project to know if the project is viable or not. NPV also allows us to determine which project is the most profitable among several investment options. Even if someone offers to buy our business, with this indicator we can determine whether the price offered is above or below what we would earn if we did not sell it.

Vt :represents the cash flows in each period t. I0 :is the value of the initial disbursement of the investment. n: is the number of periods considered.the interest rate is k. If the project has no risk, the fixed income rate is taken as a reference, so that the NPV is used to estimate whether the investment is better than investing in something safe, with no specific risk.

Van excel english

The Net Present Value (NPV) and the Internal Rate of Return (IRR) are two concepts of financial mathematics that allow the evaluation of investment projects. On the one hand, NPV arises from discounting the cash flows generated by a project over time at a rate K, which is the cost of the project. On the other hand, the IRR is the rate at which the cash flows must be discounted so that the NPV is 0. The criterion followed with this method is as follows:

We are going to see it with a simulated case. We remind you that you have available the excel template NPV and IRR in the finance section, which is the one we are going to use to carry out this practical example.

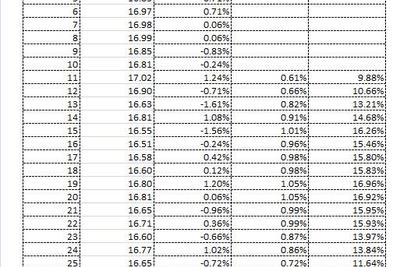

Having these two points clear, we will have initial expenses of 6,000 euros and a recurring expense during the 24 months of 18,407.75 euros. As for the income there is no doubt, it is 20,000 euros per month for 24 periods. Now, with the help of Excel, we will obtain the NPV and IRR of this project. The cash flows derived from this project are as follows:

Wikipedia

View premium template When managing a company we must have all the information about it well controlled. That’s why we often work with a large volume of documentation: reports, proposals, calculations… Before the implementation of technology in the business environment everything was done by hand, however, now, with the advent of office automation tools everything is much simpler. For example, using Excel templates to create business formulas.

One of the main objectives of these documents is decision making, these must always be based on relevant and truthful information, and often supported by calculations that determine the future of the business, such as probabilities. Such is the case of the IRR and NPV, or Internal Rate of Return and Net Present Value.

The Internal Rate of Return allows to know if it is profitable to invest in a business, considering the lowest investment risk options. It is a percentage that measures the viability of the projects. On the other hand, the Net Present Value is an investment criterion that updates the payments and collections of a project to know how much will be gained or lost in the future.

Bienvenid@, soy Patricia Gómez y te invito a leer mi blog de interés.